In the ever-evolving landscape of modern finance, two terms have been making waves and reshaping the way we interact with money: “Neobanking” and “Fintech.”

If you’ve been curious about these buzzwords and want to understand the fundamental difference between neobanks and fintech , you’ve come to the right place.

In this article, we’ll embark on a journey to demystify the Difference between Neobanking and Fintech, explore the concept of Neobanking, delve into the realm of Fintech Banken, and even discover the best Neobank options available. Whether you’re seeking to optimize your personal finances or looking for innovative solutions for your business,You will be prepared to make wise decisions in the dynamic world of finance thanks to this investigation. So, let’s dive in and decode the fascinating universe of Neobanking vs. Fintech.

Key takeaways

- Neobanks, traditional banks, and fintechs in the US offer distinct financial services and experiences.

- Novo, BlueVine, Azlo, Radius Bank, and Chime offer innovative solutions for diverse financial needs.

- Neobanks and fintechs in the US face regulatory, cybersecurity, and market competition challenges.

- Strategies like compliance frameworks and robust security measures mitigate neobank and fintech challenges in the US.

What Exactly is a Neobank?

In the fast-paced world of modern finance, the term “neobank” is making significant waves, and it’s essential to grasp precisely what it entails. A neobank is a digital, technology-driven financial institution that operates exclusively online, without any physical branch presence. Unlike traditional banks, neobanks offer various financial services and products purely through digital channels, accessible via mobile apps or websites.

One of the primary distinctions between neobanks and traditional banks lies in their business model. Neobanks, often known as fintech banks, leverage cutting-edge technology to streamline operations, reduce costs, and enhance user experiences. They prioritize user-centric design, offering a seamless and user-friendly interface, real-time financial insights, and hassle-free account management.

Additionally, neobanks tend to focus on niche markets or demographics, such as freelancers, entrepreneurs, or individuals seeking alternatives to traditional banking services. Because of their expertise, they can customize their services to meet their target market’s specific requirements, delivering simple account openings, rapid loan approvals, and cutting-edge savings features.

In conclusion, a neobank is an entirely online bank that distinguishes itself from traditional banks by providing solely online banking services., leveraging technology to simplify financial services and catering to specific customer segments. Understanding these key distinctions is crucial as we explore the differences between neobanks and fintech in greater detail in this article.

What Exactly Is Fintech?

In the ever-evolving world of finance, the term “fintech” has become increasingly prominent, and it’s essential to gain a clear understanding of what fintechs represent. Fintechs, short for “financial technology companies,” are innovative firms that harness cutting-edge technology to revolutionize and optimize various aspects of the financial industry.

Fintechs operate across a wide spectrum of financial services, spanning payments, lending, investment management, insurance, and more. They differ from conventional financial institutions in that they are more agile, technologically advanced, and user-centric. These companies leverage software, data analytics, artificial intelligence, blockchain, and other digital tools to create solutions that challenge traditional financial norms.

One of the hallmark characteristics of fintechs is their commitment to simplifying financial processes and making them more accessible to a broader audience. They often provide user-friendly mobile apps and online platforms that enable consumers and businesses to manage their finances, make payments, access credit, invest, and secure insurance coverage with ease.

Moreover, fintechs are known for their capacity to innovate rapidly, responding to evolving market trends and customer demands. Whether it’s peer-to-peer lending, robo-advisors, or digital wallets, fintechs continue to introduce groundbreaking concepts that reshape how people engage with financial services.

In summary, fintechs are pioneering financial technology companies that leverage digital innovation to create more efficient, accessible, and customer-centric financial solutions. Understanding the essence of fintechs is crucial as we explore the differences between neobanking and fintech in greater detail in this article.

A Closer Look at How Neobanks Operate

To comprehend how neobanks function, it’s crucial to grasp their operational model. Neobanks are financial institutions that only operate online and provide banking services through online platforms like mobile applications or websites.

Here’s a breakdown of how they work:

Digital-First Approach:

Neobanks have no physical branches. Instead, they rely on technology to offer a range of banking services online. Customers can open accounts, conduct transactions, and manage their finances entirely through their smartphones or computers.

Streamlined Account Setup:

Neobanks excels at simplifying the account opening process. Users can often sign up in minutes, requiring minimal documentation and providing a hassle-free alternative to traditional banks.

User-Centric Design:

Neobanks prioritize user experience. Their interfaces are intuitive, user-friendly, and feature-rich, offering real-time insights into spending, savings, and budgeting. Many neobanks provide customizable tools to help users manage their money effectively.

Innovative Features:

Neobanks frequently introduce innovative financial features. These may include automated savings plans, round-up investments, or cashback rewards designed to cater to specific customer needs and preferences.

Collaborations and Partnerships:

Neobanks often collaborate with other fintech companies to expand their service offerings. For instance, they may partner with lending platforms to offer loans or integrate with investment apps to provide seamless access to wealth management services.

Regulatory Compliance:

Neobanks operate under regulatory guidelines and adhere to stringent security measures to safeguard customers’ funds and data. They often partner with established banks to hold customer deposits, ensuring FDIC or equivalent insurance coverage.

Global Accessibility:

Many neobanks aim to serve a global audience. They may offer multi-currency accounts, low or no foreign transaction fees, and features designed for international travellers.

In essence, neobanks leverage technology to create a convenient, user-centric, and digitally-driven banking experience. They redefine how people and organizations handle their finances in the contemporary digital world by placing a priority on accessibility, innovation, and customer happiness. Understanding the workings of neobanks is essential as we explore the difference between neobanks and fintech further in this article.

Neobanks vs. Traditional Banks vs. Fintech: Unraveling the Crucial Differences

In the realm of modern finance, there are three major players that shape the financial landscape: neobanks, traditional banks, and fintech companies. To gain a comprehensive understanding of these entities,

let’s explore the key distinctions among them:

Neobanks:

- Digital-Only: Neobanks are digital-first financial institutions devoid of physical branches.

- Tech-Driven: They leverage technology to streamline operations and deliver user-centric services.

- Innovative Features: Neobanks often introduce innovative financial tools and features, catering to specific customer needs.

- Efficient Account Setup: Account creation is typically quick and straightforward and often requires minimal documentation.

- Partnerships: Neobanks collaborate with fintech companies to expand their offerings, such as loans and investments.

- Global Accessibility: Many neobanks aim to serve a global audience with multi-currency accounts and low foreign transaction fees.

- Regulatory Compliance: Neobanks operate under regulatory guidelines and prioritize security.

Traditional Banks:

- Physical Presence: Traditional banks have physical branches offering face-to-face services.

- Long History: They have a long-established history in the financial industry, with a wide range of services.

- Conservative Approach: Traditional banks tend to be more conservative in adopting new technology and innovation.

- Account Variety: They offer various types of accounts, loans, and financial products.

- Personal Relationships: Traditional banks emphasize building personal relationships with customers.

- Strict Regulations: They operate under stringent regulatory oversight.

Fintech Companies:

- Technology-First: Fintech companies are technology-driven startups or firms specializing in financial services.

- Innovation Hub: They constantly innovate, introducing disruptive solutions in payments, lending, investments, and more.

- Collaborations: Fintechs often collaborate with banks or integrate their services into existing financial infrastructure.

- Digital Accessibility: Services are typically accessible through apps or websites, emphasizing convenience.

- Niche Specialization: Fintechs can target specific niches, such as peer-to-peer lending, robo-advisors, or blockchain solutions.

- Regulatory Compliance: They adhere to financial regulations while pushing boundaries in financial innovation.

Understanding the distinctions among neobanks, traditional banks, and fintech companies is vital in navigating the evolving financial landscape. Each of these players offers unique advantages and caters to different customer preferences and needs.

Why Choose a Neobank?

In the dynamic landscape of modern finance, neobanks have emerged as compelling alternatives to traditional banking and fintech solutions. Understanding the benefits of a neobank is crucial for individuals seeking innovative financial services tailored to their needs.

Here, we explore the advantages of opting for a neobank in the United States:

Digital Convenience:

Neobanks offers seamless online and mobile banking experiences, allowing users to manage their finances anytime, anywhere. Physical branch visits are no longer necessary thanks to this convenience.

Quick and Easy Setup:

Opening an account with a neobank is often a straightforward process, often completed within minutes, requiring minimal documentation compared to traditional banks.

User-Centric Design:

Neobanks prioritize user experience, providing intuitive interfaces, real-time financial insights, and user-friendly tools for budgeting and savings.

Innovative Features:

Neobanks frequently introduce innovative financial tools, such as automated savings plans, round-up investments, and cashback rewards, enhancing financial management.

Competitive Fees:

Many neobanks offer fee structures that are more transparent and competitive than traditional banks, with reduced or no account maintenance fees and low foreign transaction fees.

Specialized Services:

Neobanks often cater to niche markets, offering specialized services for freelancers, entrepreneurs, travellers, and more, addressing specific financial needs.

Global Accessibility:

Some neobanks provide multi-currency accounts and international features, making them ideal for individuals and businesses with global financial activities.

Collaborations:

Neobanks frequently partner with fintech companies to extend their services, such as offering loans, insurance, or investment opportunities, creating a one-stop financial hub.

Security:

Neobanks prioritizes security and data protection, employing advanced encryption and authentication measures to safeguard customer information.

Transparency:

Neobanks typically offer transparent fee structures and straightforward terms and conditions, reducing hidden charges and unexpected costs.

Understanding these benefits empowers individuals to make informed decisions about their banking preferences. Neobanks offers a modern, user-centric, and technologically-driven approach to banking, aligning with the evolving needs of today’s consumers in the United States.

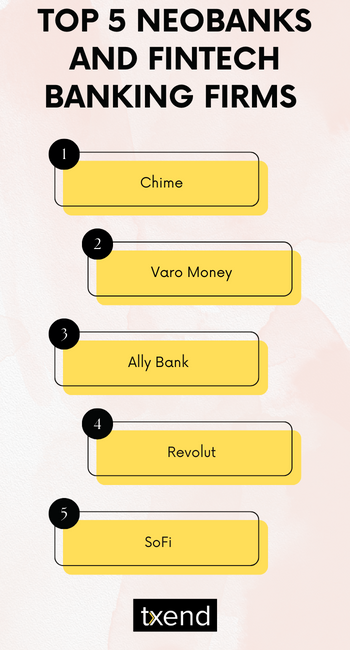

Exploring the Top 5 Neobanks and Fintech Banking Firms What Sets Them Apart

In the dynamic landscape of modern finance, several standout neobanks and fintech banking firms have emerged, each with its unique offerings.

Let’s delve into the top 5 of these innovative players and uncover what makes them distinct:

Chime:

Chime is a leading neobank known for its fee-free banking and user-centric approach. It offers early direct deposit, automatic savings features, and a user-friendly mobile app.

Varo Money:

There are no monthly fees associated with the full range of financial services offered by Varo Money, which includes checking and savings accounts. They provide cashback incentives and budgeting features on their app.

Ally Bank:

Ally Bank combines the convenience of a digital bank with the backing of a traditional institution. It offers competitive savings account rates, no monthly maintenance fees, and a range of financial products.

Revolut:

Revolut is a fintech banking firm with a global presence, offering multi-currency accounts, international money transfers at competitive rates, and cryptocurrency support.

SoFi:

SoFi is a fintech company that focuses on lending, investing, and financial planning. They offer personal loans, student loan refinancing, investment accounts, and financial advice.

Each of these neobanks and fintech firms brings its unique value proposition to the table, catering to diverse financial needs and preferences. Whether you’re looking for fee-free banking, international financial services, or innovative investment solutions, these top players have something distinct to offer. What makes them unique will be covered in detail in this article, helping you make informed decisions in the world of difference between neobanks and fintech.

Difference Between Neobanking And Fintech Key Challenges

As we explore the difference between neobanks and finteche, it’s essential to understand the unique challenges and considerations that arise in the USA.

Here are some critical challenges to keep in mind:

Regulatory Landscape:

The USA has a complex and evolving regulatory environment for financial institutions. Neobanks and fintech companies must navigate federal and state regulations, which can vary significantly.

Security and Data Privacy:

Making sure the security and privacy of consumer information is a primary priority due to the rising prevalence of cyber threats and data breaches. It is crucial to adhere to strict security standards.

Customer Trust:

It might be difficult to gain and keep the trust of customers, especially for newer neobanks and fintech startups. Established banks may have an advantage in this area due to their long history.

Competition:

The financial services sector in the USA is highly competitive. Neobanks and fintechs must differentiate themselves to stand out and attract customers.

Customer Acquisition Costs:

It might be expensive to bring in new clients.Neobanks and fintech companies must develop effective marketing strategies to acquire and retain customers while managing acquisition costs.

Partnerships:

Collaborating with traditional banks or fintech partners can be challenging due to differences in business models and objectives. Finding mutually beneficial partnerships is key.

Scalability:

Neobanks and fintechs often face challenges when scaling their operations to accommodate a growing customer base. Ensuring systems can handle increased demand is crucial.

Regulatory Compliance:

Staying compliant with changing regulations is an ongoing challenge. Neobanks and fintechs must allocate resources to monitor and adapt to regulatory changes.

Financial Inclusion:

Ensuring that financial services are accessible to underserved populations is a social responsibility and regulatory requirement in the USA.

Customer Education:

Educating customers about the advantages and limitations of neobanking and fintech services is essential to their adoption and satisfaction.

Understanding and addressing these challenges is vital for neobanks and fintech companies operating in the USA market. By navigating these obstacles effectively, they can provide innovative financial solutions while building trust and credibility in the highly competitive financial industry.

Mitigating Hurdles in Neobanking and Fintech

How they navigate these hurdles to ensure sustainable growth and customer satisfaction.

Regulatory Compliance:

Both neobanks and fintech firms must navigate complex and evolving regulatory frameworks. Ensuring compliance with financial regulations while embracing innovation is a delicate balance.

Customer Trust:

Establishing and maintaining trust is crucial, especially for neobanks, as they lack the physical presence of traditional banks. Fintechs also need to convince users of the security and reliability of their digital platforms.

Cybersecurity Risks:

With the increasing digitization of financial services, cybersecurity threats are a constant concern. Neobanks and fintechs must invest in robust security measures to protect customer data and assets.

Competition:

The neobanking and fintech sectors are highly competitive. Standing out and gaining market share requires innovative solutions and effective marketing strategies.

Scalability:

Managing rapid growth while maintaining service quality is a challenge for both neobanks and fintechs. Scalability issues can arise if infrastructure and support systems are not adequately prepared.

Monetization Strategies:

Many neobanks and fintech companies offer free or low-cost services initially, relying on alternative monetization methods like fees, partnerships, or premium offerings. Balancing revenue generation with customer value is critical.

Partnerships and Integration:

Fintechs often seek partnerships with traditional banks or other fintech firms to expand their services. Navigating these collaborations successfully requires strategic planning and alignment.

Customer Education:

Neobanks and fintechs must educate users about their innovative offerings and how to maximize their benefits. Simplifying complex financial concepts is a priority.

Market Volatility:

Economic fluctuations and shifts in the consumer behaviour can impact neobanks and fintechs. Adapting to changing market conditions is essential for long-term success.

Data Privacy:

Protecting customer data and adhering to data privacy regulations are paramount. Mishandling sensitive information can lead to legal and reputational consequences.

By addressing these challenges effectively, neobanks and fintech companies can continue to drive innovation in the financial industry and provide customers with cutting-edge, reliable, and secure financial services.

FAQs:

Primary distinction: Neobanks are digital-only, branchless institutions, while traditional banks have physical branches and offer face-to-face services in the US

Neobanks and fintech firms collaborate through APIs, integrating technology for seamless user experiences, encompassing payments, lending, and innovative solutions.

Advantages of neobanks in the US: Digital convenience, lower fees, faster transactions, innovative features, user-friendly interfaces, tailored services, and accessibility.

Neobanks in the US offer services like checking and savings accounts, loans, budgeting tools, and payment services via mobile apps.

Businesses benefit from US business neobanks through streamlined operations, cost-efficiency, and tailored services. Top options include Novo, BlueVine, and Azlo.

Conclusion:

In the dynamic world of modern finance, the difference between neobanks and fintech companies has never been more critical. Through our exploration of “Neobanking vs. Fintech: Understanding the Key Distinctions,” we’ve uncovered the fundamental differences that set these two financial innovators apart.

Neobanks, with their digital-only presence and technology-driven approach, offers a fresh perspective on banking. They offer a streamlined and user-centric interface, enabling people and businesses to easily manage their funds. Neobanks have become known for their innovative features, streamlined account setup, and commitment to enhancing customer satisfaction.

On the other hand, fintech companies, spanning a diverse range of financial services, constantly push the boundaries of innovation. They leverage technology to create disruptive solutions that challenge traditional financial norms. Fintechs excel in areas like peer-to-peer lending, robo-advisors, and blockchain applications, catering to the diverse needs of the modern financial landscape.

As you navigate your financial journey, whether as an individual or a business, understanding these distinctions empowers you to make informed decisions. Consider your specific needs, preferences, and goals when choosing between neobanks, traditional banks, or fintech services. Each option offers unique advantages, and the right choice depends on how well it aligns with your financial aspirations.

In this era of rapid technological advancement, neobanks and fintech represent the future of finance—a future where accessibility, innovation, and customer-centricity take center stage. By grasping the nuances of these financial disruptors, you can harness their capabilities to optimize your financial life and embrace the opportunities of the digital age